You are here:Chùa Bình Long – Phan Thiết > chart

Who is Setting the Price of Bitcoin?

Chùa Bình Long – Phan Thiết2024-09-22 07:27:10【chart】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and deba airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and deba

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and debate since its inception in 2009. One of the most frequently asked questions about Bitcoin is: who is setting the price of Bitcoin? This article aims to explore the factors that influence the price of Bitcoin and the entities involved in this process.

Firstly, it is important to understand that the price of Bitcoin is determined by the supply and demand dynamics in the market. Unlike traditional fiat currencies, Bitcoin has a finite supply, with a maximum of 21 million coins that can be mined. This scarcity has contributed to the volatility of Bitcoin's price over the years.

The primary factor that drives demand for Bitcoin is its perceived value as a store of wealth and a hedge against inflation. Many investors view Bitcoin as a digital gold, and its price tends to rise during times of economic uncertainty or when there is a loss of faith in the traditional financial system. Conversely, when the economy is stable and investors have confidence in fiat currencies, the demand for Bitcoin may decrease, leading to a drop in its price.

Several entities play a role in setting the price of Bitcoin:

1. Retail Investors: Individual retail investors are among the most significant contributors to the demand for Bitcoin. Their buying and selling activities can cause significant price fluctuations. For instance, when a large number of retail investors buy Bitcoin, its price tends to rise, and vice versa.

2. Institutional Investors: Institutional investors, such as hedge funds, pension funds, and investment banks, have a significant impact on the price of Bitcoin. These investors often have substantial capital to allocate to cryptocurrencies, and their participation in the market can lead to substantial price movements.

3. Whales: Whales refer to individuals or entities that hold a large number of Bitcoin. Their buying and selling activities can significantly influence the price of Bitcoin. For example, if a whale decides to sell a substantial portion of their Bitcoin holdings, it could lead to a drop in the price.

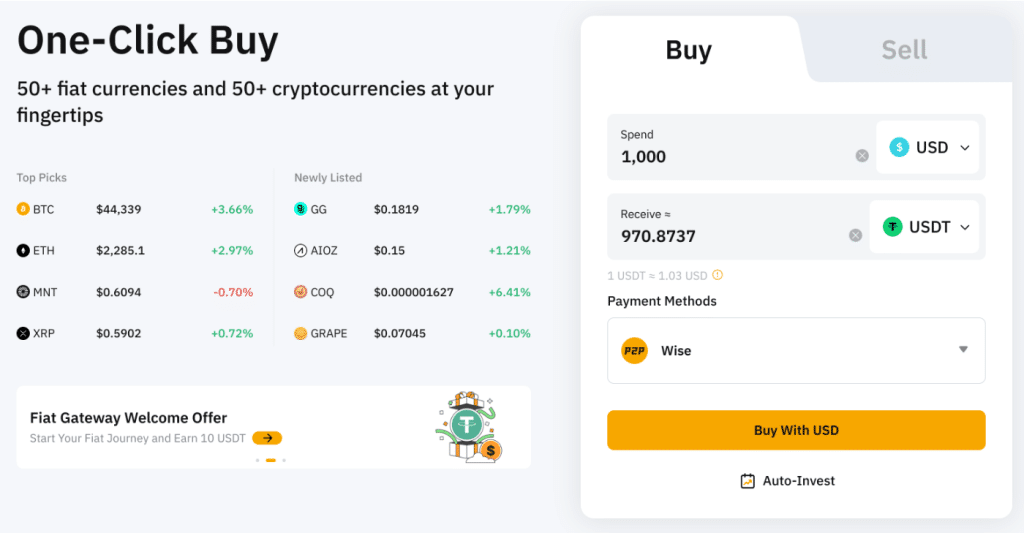

4. Exchanges: Cryptocurrency exchanges play a crucial role in setting the price of Bitcoin. These platforms facilitate the buying and selling of Bitcoin and other cryptocurrencies. The trading volume on these exchanges can impact the overall price of Bitcoin. Additionally, the fees charged by exchanges can also affect the price.

5. Governments and Regulatory Bodies: Governments and regulatory bodies can influence the price of Bitcoin through their policies and regulations. For instance, if a government bans Bitcoin or imposes strict regulations on cryptocurrency exchanges, it could lead to a decrease in demand for Bitcoin and a subsequent drop in its price.

6. Media and Public Perception: The media and public perception also play a role in setting the price of Bitcoin. Positive news about Bitcoin, such as increased adoption or partnerships with major companies, can lead to a rise in its price. Conversely, negative news or fears about Bitcoin can cause its price to fall.

In conclusion, the price of Bitcoin is influenced by a variety of factors, including supply and demand dynamics, the actions of retail and institutional investors, the behavior of whales, the role of exchanges, government policies, and public perception. While it is challenging to pinpoint a single entity that sets the price of Bitcoin, it is evident that the price is influenced by a complex interplay of these factors. As the cryptocurrency market continues to evolve, it will be interesting to observe how these factors shape the future of Bitcoin's price.

This article address:https://www.binhlongphanthiet.com/btc/23c70999267.html

Like!(8)

Related Posts

- Bitcoin Cash Frozen: The Impact on the Cryptocurrency Market

- Can I Buy Bitcoin Through Etrade?

- Floki Inu Binance Price: A Comprehensive Analysis

- How to Send Bitcoin from Etoro to Wallet: A Step-by-Step Guide

- Bitcoin Wallet Used in Ecuador: A Gateway to Financial Freedom

- Bitcoin Price High in 2017: A Record-Breaking Year for Cryptocurrency

- Title: Unlocking the Potential of Bitcoin Mining with GitHub Scripts

- Unlocking the Power of Crypto Tracker Binance API: Your Ultimate Guide

- Can I Buy Bitcoin on Scottrade?

- Bitcoin Price on January 1, 2012: A Look Back at the Cryptocurrency's Early Days

Popular

Recent

How to Stop Loss on the Binance App: A Comprehensive Guide

Best Free Desktop Bitcoin Wallet: Your Ultimate Guide to Secure and Convenient Cryptocurrency Management

Binance.US Fees vs Coinbase: A Comprehensive Comparison

How to Buy Binance Smart Chain Token: A Comprehensive Guide

How to Make a Physical Bitcoin Wallet: A Step-by-Step Guide

Bitcoin Price Prediction Per Month: A Comprehensive Analysis

### 30 Dollar in Bitcoin Can Make You Rich: A Journey into the Cryptocurrency World

Binance.US Fees vs Coinbase: A Comprehensive Comparison

links

- Binance Flexible Savings USDT: A Game-Changer for Crypto Investors

- USDC vs USDT Binance: A Comprehensive Comparison

- Bitcoin Cash Realtime Kurs: The Future of Cryptocurrency

- Murphysboro Bitcoin Mining: A Booming Industry in Southern Illinois

- Worldgilt Bitcoin Mining: The Future of Cryptocurrency Extraction

- Bitcoin Cash Realtime Kurs: The Future of Cryptocurrency

- What Crypto Can Be Bought on Binance: A Comprehensive Guide

- Safemoon Crypto on Binance: A Growing Trend in the Cryptocurrency Market

- **Report Bitcoin Wallet Address: A Guide to Identifying and Reporting Suspicious Activity

- ### Resolving the Iota Wallet Tag is Invalid Send to Binance Issue